Understanding How Private Money Lenders Atlanta Assess Your Loan Application

Understanding How Private Money Lenders Atlanta Assess Your Loan Application

Blog Article

Checking out the Perks and Characteristics of Loaning Solutions for Your Economic Demands

When it involves handling your funds, comprehending loaning services can be a game changer. Individual loans can aid with unanticipated expenditures, while organization lendings might sustain your business dreams. Exactly how do you choose the right alternative? And what aspects should you take into consideration to assure you're making an audio decision? As we explore these inquiries, you'll discover insights that might lead to far better economic stability and success.

Recognizing Different Kinds of Loaning Provider

When it pertains to lending solutions, you'll find a range of options customized to fulfill different economic needs. Individual car loans are versatile and can be made use of for anything from financial obligation loan consolidation to unforeseen expenditures. If you're wanting to acquire a home, home loan supply the necessary funding, while automobile loans assist you acquire a car. For local business, company car loans supply capital to grow procedures or take care of cash circulation.

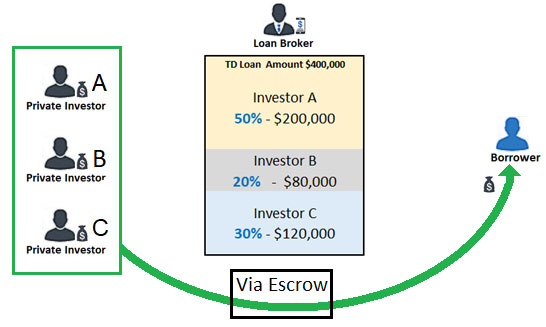

If you require a fast remedy, cash advance offer you temporary accessibility to money, though they typically include high-interest rates. Peer-to-peer lending connects you with individual investors, supplying an extra personal strategy. In addition, lines of credit report provide you versatility, allowing you to obtain just what you require when you require it. Comprehending these options encourages you to select the best borrowing solution that aligns with your financial objectives.

The Benefits of Individual Car Loans

Personal finances stand out as a versatile financial option that can deal with a variety of needs. Whether you're dealing with unanticipated costs, funding a significant acquisition, or settling financial obligation, personal finances can provide the money you require rapidly. Among the main benefits is their convenience; you can use the funds for practically anything, offering you control over your monetary choices.

Another advantage is the foreseeable repayment structure. With dealt with interest rates and established monthly settlements, you can easily budget plan and strategy your funds. Plus, personal finances typically have actually much shorter terms contrasted to various other kinds of car loans, permitting you to repay your debt faster.

In addition, obtaining a personal finance can help strengthen your credit history if you make timely payments. This can be important when you need to borrow in the future. In general, personal finances supply a sensible, obtainable option for managing your financial demands effectively.

Exploring Business Lending Options

Kinds of Organization Lendings

Standard bank loans usually use lower passion rates and longer settlement terms, making them excellent for larger tasks. For short-term needs, take into consideration a short-term financing, which provides fast funding yet normally comes with higher rate of interest rates. Each loan type has unique functions, so review your service demands and choose the one that lines up finest with your objectives.

Eligibility and Demands

Recognizing the eligibility and demands for business loans is necessary to guarantee you secure the funding you need. A strong credit score demonstrates your capability to manage financial obligation responsibly, while consistent earnings reveals you can pay off the finance. Satisfying these criteria increases your opportunities of acquiring the right lending for your business demands.

Application Refine Introduction

Prior to diving right into the application procedure for business finances, it is crucial to discover the various alternatives available to you. Begin by recognizing the kind of funding you require-- whether it's a term loan, line of credit report, or SBA finance. Once you have actually cleared up on a lending type, collect required papers like your service strategy, economic declarations, and tax returns.

The Role of Credit in Loaning Services

Your credit report plays a necessary duty in the borrowing procedure, affecting whatever from funding approval to the rate of interest you'll face. Lenders evaluate this score to establish your credit reliability and danger level. Understanding how your credit history impacts these factors can help you make notified financial choices.

Credit Score Rating Relevance

While numerous factors influence lending decisions, your credit rating often attracts attention as a vital aspect. It shows your creditworthiness, revealing lending institutions how accurately you pay off borrowed cash. A greater score can open far better lending terms, reduced rate of interest prices, and increased line of credit. Alternatively, a low score could bring about higher prices or perhaps funding denial. It is essential to maintain an eye on your debt record, dealing with any kind of errors and handling your debts sensibly. On a regular basis paying expenses in a timely manner and preserving reduced credit report card equilibriums can boost your rating. Bear in mind, lenders watch your credit report rating as a window right into your financial routines, so nurturing it can considerably enhance your borrowing chances. Prioritize your credit score wellness to safeguard the very best loaning options.

Funding Approval Refine

Understanding the funding authorization process is vital for anyone looking for financial assistance. When you apply for a funding, loan providers evaluate your credit background and score to identify your qualification. Bear in mind, a favorable credit report account not just help in securing car loans but likewise increases your overall monetary wellness.

Interest Prices Impact

When using for a lending, the interest rates you experience can considerably affect your general economic burden, especially if your credit rating rating isn't up to par. This distinction can lead to significant expenses over the life of the loan. Remember, a better credit report score not just lowers your passion rates however can also boost your chances of car loan authorization, making your financial journey smoother and much more economical.

How to Select the Right Lending Solution for Your Demands

Start by reviewing your details requirements-- are you looking for a personal funding, mortgage, or probably a line of credit score? Compare interest rates, charges, and finance terms to discover the ideal bargain.

Examine the loan provider's online reputation by checking out evaluations and looking for recommendations from good friends look at this web-site or family members. See this contact form to it the loan provider is qualified and has a clear procedure. Focus on customer care; you'll desire a lending institution that's receptive and valuable.

A great financing solution will be prepared to make clear any type of uncertainties you have. By taking these steps, you'll be better geared up to choose a financing service that fits your monetary requirements properly.

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

The Application Refine: What to Anticipate

As you start the application process for a loaning solution, it's important to recognize what to expect to enhance your experience. Collect necessary documentation, such as evidence of revenue, recognition, and your credit rating history. This information will help loan providers assess your economic situation.

Following, you'll complete an application type, either online or in-person. Be prepared to address questions concerning your monetary requirements and goals. Once submitted, the lender will certainly examine your application, which might take a couple of days. They may call you for extra info, so stay responsive.

After authorization, you'll receive funding terms detailing rate of interest prices, repayment timetables, and any costs. Very carefully assess these terms prior to finalizing. Finally, as soon as you approve the offer, the funds will normally be paid out soon thereafter. Recognizing these actions can make the check this site out application process smoother and a lot more effective, aiding you secure the monetary assistance you need.

Tips for Handling Your Loans Efficiently

Efficient loan monitoring is crucial for preserving your financial health, particularly after you've protected funding. Regularly assess your financing terms and rate of interest rates-- if you locate much better options, take into consideration refinancing to save cash.

Stay arranged by keeping track of your due days and any type of communication with your lending institution. If you come across financial troubles, don't wait to connect to your lender; they might offer adaptable repayment options. Make extra settlements when feasible to lower your primary balance faster, which can conserve you on interest in the lengthy run. By following these ideas, you can handle your finances effectively and preserve a strong financial structure.

Regularly Asked Inquiries

How Do Rate Of Interest Range Various Lending Solutions?

Rate of interest prices range borrowing services based on elements like credit rating score, financing type, and market conditions. You'll discover reduced prices with far better credit history, while higher-risk financings typically come with enhanced passion prices. Always contrast options.

What Files Are Normally Needed for Lending Applications?

When you look for a finance, you'll typically require to provide identification, proof of earnings, credit rating, and sometimes collateral information. These documents help loan providers evaluate your monetary scenario and establish your eligibility.

Can I Apply for Numerous Lendings All At Once?

Yes, you can get multiple car loans all at once. Just understand that lenders may check your credit scores record for each application, which can affect your credit history. It's vital to manage your finances very carefully during this procedure.

What Occurs if I Miss a Car Loan Payment?

If you miss out on a lending settlement, your loan provider may bill late fees, report it to credit scores bureaus, and your credit history might drop. It's crucial to interact with your lender to go over potential choices and solutions.

Exist Any Concealed Fees Connected With Lending Providers?

Yes, there can be hidden costs related to loaning solutions - Private Money Lenders Atlanta. You must carefully examine the lending arrangement, as charges for late settlements, processing, or very early settlement might use. Constantly ask questions to stay clear of shocks

Report this page